Smart contracts for insurance payments: automation that reduces processing times from weeks to hours

Problem: long lead times and high costs

A typical insurance claim: a patient receives medical care in February, submits documents in April, and receives payment in June.

Depending on the product line and country, the time frame ranges from several weeks to a couple of months—regulatory windows are often limited to 30–45 days from the date of receipt of the complete set of documents, but in practice, the process is prolonged due to revisions and repeated requests.

During this time, the insured makes an average of 3–4 calls to the insurance company, sends the missing documents twice, and the company incurs significant administrative costs.

According to Premier (2023), the average additional administrative cost for a single disputed claim is $57 (≈₽5,000 at an exchange rate of ₽87/USD). This is only part of the total costs, which include employee labor, infrastructure, and manual checks.

Average NPS scores in insurance, according to industry data, range from 20 to 40 points, and a score above 40 is considered an excellent result — which indicates a systemic problem with the customer experience.

Alternative scenario: automation through smart contracts

Data about an insured event is automatically transferred to the system, where a smart contract verifies it and generates a payout.

In parametric scenarios (e.g., weather insurance), the decision can be made in a matter of hours, and in health insurance, it can reduce the time frame from weeks to 1–3 days, provided that all data is received in machine-readable form via API.

This approach is already being implemented in a number of pilot projects and products (Lemonade Foundation, IBM–Anthem–Aetna–PNC, Nexus Mutual) and is showing measurable results in terms of cost reduction and increased transparency.

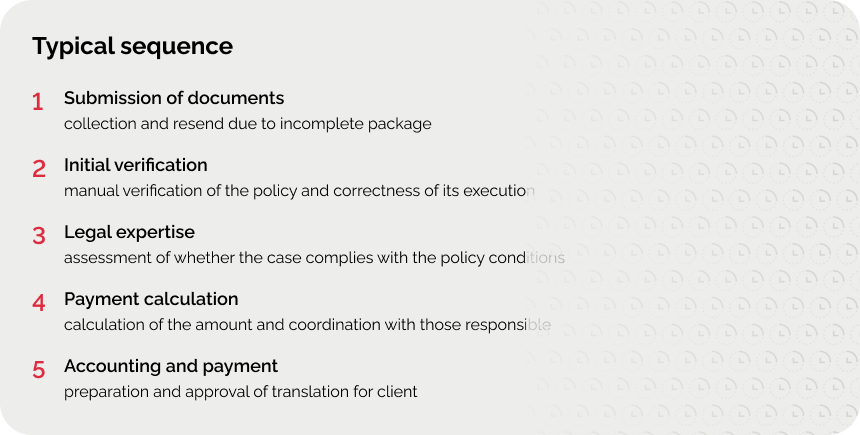

Traditional process: decomposition of stages and costs

Modern insurance claims processing involves several levels of verification: document collection, legal review, financial approval, and payment.

Total duration: 25–45 days, depending on the complexity and completeness of the data.

Challenging factors:

- manual processing and resubmissions due to errors;

- variability in the interpretation of coverage terms;

- multi-level approvals;

- proportion of erroneously rejected claims that are later reviewed (according to Premier and Experian Health).

Automation through smart contracts: architecture and implementation

A smart contract is executable code in a blockchain that automatically fulfills the terms of a contract when specified parameters are met.

System architecture:

- Data sources (EHR/MIS) — the medical system records diagnoses and procedures.

- API gateway — converts data into blockchain format, performs initial validation.

- Blockchain network — stores cryptographic hashes rather than personal data.

- Smart contract — checks policy activity, coverage conditions, limits, and fraud signals.

Important:

- Oracles (e.g., Chainlink) are used to interact with external systems, as EVM contracts do not make HTTP requests directly.

- Hashes are stored on-chain, while encrypted medical data is stored off-chain. According to the recommendations of the European Data Protection Board, even a hash can be considered personal data, so a DPIA, legal grounds, and minimization of access are required.

Economic model: impact assessment

Let’s consider an example for an insurance company that processes 120,000 cases per year.

| Cost Item | Average Cost, USD |

|---|---|

| Call Center (3–4 requests, ~1 hour) | $27 |

| Document Review (4 hours) | $156 |

| Legal Review (2 hours) | $133 |

| Financial Check (1 hour) | $44 |

| Accounting & Payments | $17 |

| IT & Overhead Costs | $28 |

| Re-checks | $20 |

| Total | ≈ $425 |

After the implementation of smart contracts:

| Cost Item | Average Cost, USD |

|---|---|

| API Integration & Support | $7 |

| Infrastructure & Monitoring | $8 |

| Audits & Updates | $9 |

| Total | ≈ $24 |

Savings

Calculation:

($425−$24)×120,000×0.8≈$38.5M

After deductions:

- Initial CAPEX: $0.67M

- Annual OPEX: $0.13M

→ Net annual savings: ≈ $37.7M per year

Even with only 40% automation, the impact still exceeds: ≈ $18.9M annually, with a payback period of 1.5–3 months after pilot launch.

Real-life cases

Lemonade Foundation — weather insurance for farmers

- Smart contracts track weather station data; in the event of drought or flooding, payments are made automatically.

- In pilot projects with Kenyan farmers, payment times have been reduced from months to days (Artemis, 2024).

IBM, Anthem, Aetna, PNC — blockchain ecosystem for health insurance

- Goal: reduce data discrepancies and costs through a shared network.

- This is a data exchange ecosystem, not a ready-made “pay-by-the-hour” product. (PR Newswire, 2019).

Nexus Mutual — insurance for DeFi protocols

- Payments for insured hacks are made automatically after data verification on the blockchain.

- Since 2019, ~$18.5 million has been paid out, with average processing times ranging from several days to weeks.

Safety and regulation

Blockchain itself is stable, but errors in smart contract code can lead to losses. Therefore, a security audit (OWASP, ConsenSys Diligence) is conducted before implementation.

Regulatory sandbox regimes in the UK (FCA), Singapore (MAS), and the UAE (ADGM) allow such solutions to be tested under supervision. In the EU, the MiCA directive regulates digital asset infrastructure, but approaches to data management and system compatibility are more relevant for medical insurance.

Roadmap: implementation in 8–12 weeks

Phase 1. Discovery (2 weeks)

— process audit, data analysis, selection of a pilot direction, ROI calculation.

Phase 2. Pilot (4–6 weeks)

— development and testing of smart contracts, integration, code audit.ё

Phase 3. Scaling (2–4 weeks)

— rollout, KPI monitoring, optimization, and staff training.

When automation is right for your company

Automation is most effective when:

- there is a large volume of repetitive cases;

- processing costs are high;

- the digital infrastructure is ready (EHR, CRM, API);

- customers complain about long payment times.

Conclusion

Smart contracts allow you to reduce payment times from weeks to days, cut operating costs by up to 90%, and recoup your investment within a quarter.

The technology does not require a complete overhaul of your systems — all you need to do is integrate the API and start with simple use cases.

Not sure if this approach is right for your company?

We can conduct an express audit of your processes, calculate the savings, and propose an implementation plan.

Rate this article!

Leave your comment