Comparing blockchain networks for smart contracts: Ethereum, Polygon, BNB, Solana — which one to choose for your project

The decision on which blockchain to choose for a smart contract determines the architecture, cost, and scalability of the project. For technical managers of traditional businesses, this choice boils down to analyzing the trade-offs between key parameters: decentralization, security, speed, and transaction costs.

The networks under consideration — Ethereum, Polygon, BNB Chain, and Solana — offer different approaches to solving these problems. A direct comparison helps to make an informed decision based on the requirements of a specific project.

Why choosing the right blockchain determines the success of a project

Once published, the smart contract code is fixed. Any significant update requires deploying a new contract and transferring data, which is a complex and costly operation.

Therefore, the initial choice of blockchain network is a strategically important decision.

The network affects key project parameters:

- Operating costs. Each operation in a smart contract requires a commission fee. For applications with thousands of daily micropayments, this factor becomes decisive for the project’s economics.

- Throughput. A limited number of transactions per second creates a queue under load, increasing commissions and confirmation times. This is critical for games, trading platforms, and applications with active user interaction.

- Security and stability. The level of decentralization and the consensus mechanism of the network determine its resistance to attacks. Security is a priority for storing high-value assets or managing financial flows.

- Ecosystem and compatibility. Ready-made infrastructure speeds up development: libraries, tools, auditors, and wallet integrations already exist. In addition, compatibility with the Ethereum Virtual Machine (EVM) has become an industry standard, making it easier to find developers.

The wrong choice at the start leads to prohibitive operating costs or the need for complex migration in the future. Let’s take a look at each network.

Ethereum: the benchmark for security and decentralization

Ethereum became the first public platform to implement smart contract functionality. As of 2025, this network maintains its leading position in terms of decentralization and security among similar solutions, as confirmed by the distribution of nodes and market share in the institutional DeFi protocols segment.

Technical foundation. Smart contracts in Ethereum are executed in an isolated environment — the Ethereum Virtual Machine (EVM). EVM ensures deterministic execution: a contract deployed on the network will work identically on any node. The ERC-20 and ERC-721 token standards were created here.

Advantages:

- Security leader. The most decentralized of all smart contract platforms, providing the highest level of asset protection.

- Liquidity center. The Ethereum ecosystem (L1 + L2) accounts for the largest share of funds in DeFi — according to various estimates, around 50–60% of TVL, and higher in certain periods.

- Industry standard. Key infrastructure (tools, oracles, token standards) is built for Ethereum, minimizing risks.

Disadvantages

- Unpredictably high fees on L1. At peak load, transaction costs are measured in tens of dollars, making the base layer unsuitable for mass applications.

- Limited L1 throughput. Throughput is intentionally limited (~15-25 TPS) for decentralization, creating a bottleneck.

- High competition and cost of entry. Expensive audits and competition for block space with giants like Uniswap create a barrier for new projects.

Use cases:

- High-budget DeFi protocols where asset security is a priority.

- Issuing digital assets for institutional clients where trust in the platform is a key factor.

- Corporate smart contracts for managing high-value guarantees or supply chains.

Ethereum should be considered as a basic security layer, the operation of which requires a significant budget.

Polygon: a scalable solution with EVM compatibility

Polygon was developed to solve Ethereum’s scaling issues. The ecosystem’s flagship solution, the Polygon PoS network, is a standalone blockchain that is fully compatible with Ethereum. The network’s architecture provides high throughput and reduces transaction costs compared to the base layer of Ethereum.

Technical foundation. Polygon PoS is fully compatible with EVM. Smart contracts written in Solidity for Ethereum can be deployed on Polygon without modification. The network uses a hybrid Proof-of-Stake consensus and periodically fixes checkpoints on the main Ethereum network.

Advantages:

- Low and predictable transaction costs. Fees are fractions of a cent, making the network suitable for micropayments.

- High throughput. The network claims a theoretical throughput of up to ~7000 TPS. In practice, the actual load is significantly lower, but still considerably higher than that of Ethereum L1.

- Full compatibility with the Ethereum ecosystem. Developers use their familiar tool stack and have access to popular protocols.

Disadvantages:

- Relatively lower decentralization. The network is supported by a limited set of validators.

- Dependence on bridges with Ethereum. The security of assets transferred from Ethereum depends on the reliability of the bridge contract.

Use cases:

- Massive NFT marketplaces and games where users make thousands of inexpensive transactions.

- Applications targeting retail users for whom the high cost of Ethereum gas is a barrier.

- Projects that want to operate in a familiar EVM environment with high throughput.

Polygon solves the scalability problem for the EVM environment by offering a compromise between cost, speed, and security.

BNB Chain: Performance for the Mass Market

BNB Chain is an EVM-compatible blockchain built for high transaction throughput. Its architecture ensures low and predictable fees, making it the technical foundation for mass-market applications.

Technical foundation. The network uses a Proof-of-Staked Authority (PoSA) consensus mechanism with a limited set of validators. Full compatibility with the Ethereum Virtual Machine (EVM) allows developers to port projects from Ethereum and use existing tools.

Advantages:

- High speed and low cost. Fees are less than $0.01, with a stated throughput of 2,000-5,000 transactions per second.

- Integration with the largest crypto exchange. Integration with the Binance ecosystem simplifies user onboarding and access to liquidity.

- The network is integrated with the ecosystem of the largest cryptocurrency exchange by trading volume, providing direct access to a multi-million user base.

Disadvantages:

- High degree of centralization. The limited number of validators and the influence of the Binance team call decentralization into question.

- History of network failures. BNB Chain has a reputation for complete shutdowns. In the past, the blockchain has been suspended to fix technical issues, which has been criticized by the community for its centralized approach to maintenance.

- Focus on retail trading. The BNB Chain ecosystem is dominated by trading and farming applications, while enterprise and complex financial protocols are underrepresented.

Use cases:

- Projects targeting a retail audience, where Binance is the primary entry point.

- Fast MVPs and prototypes where low deployment costs are critical.

- Tokenization and launch of DeFi protocols where immediate audience accessibility is important.

BNB Chain offers a solution for launching high-performance EVM applications with access to a mass audience, but with compromises in decentralization.

Solana: architecture for maximum performance

Solana uses an architecture that differs from the EVM networks discussed above. This blockchain is not compatible with the Ethereum virtual machine and is designed to achieve maximum transaction throughput through a unique technical approach.

Technical foundation. Solana uses a hybrid consensus mechanism: Proof-of-Stake combined with Proof-of-History. This allows validators to process transactions in parallel. Smart contracts are written in Rust or C.

Advantages:

- Throughput. The theoretical maximum is 65,000 transactions per second, with thousands possible in practice.

- Low transaction costs. Fees in Solana remain consistently low, averaging fractions of a cent (around $0.0002–0.001 for a simple transaction), which has virtually no impact on the economics of most applications.

- Fast final confirmation. Block confirmation time is around 400 ms.

Disadvantages:

- Complexity of development and high entry barrier. Rust and C languages are more complex than Solidity, and the execution model is significantly different.

- Periodic network failures. The Solana network has completely or partially shut down several times due to technical failures and overloads, which indicates risks for mission-critical applications.

- High hardware requirements. Running a full node requires powerful equipment.

Use cases:

- High-frequency applications: DEX aggregators, trading bots, where speed is a key advantage.

- Gaming projects that require processing millions of events online.

- Applications where a fixed ultra-low commission is the basis of the economic model.

Solana is a choice in favor of maximum performance, accompanied by increased technical risks and development complexity.

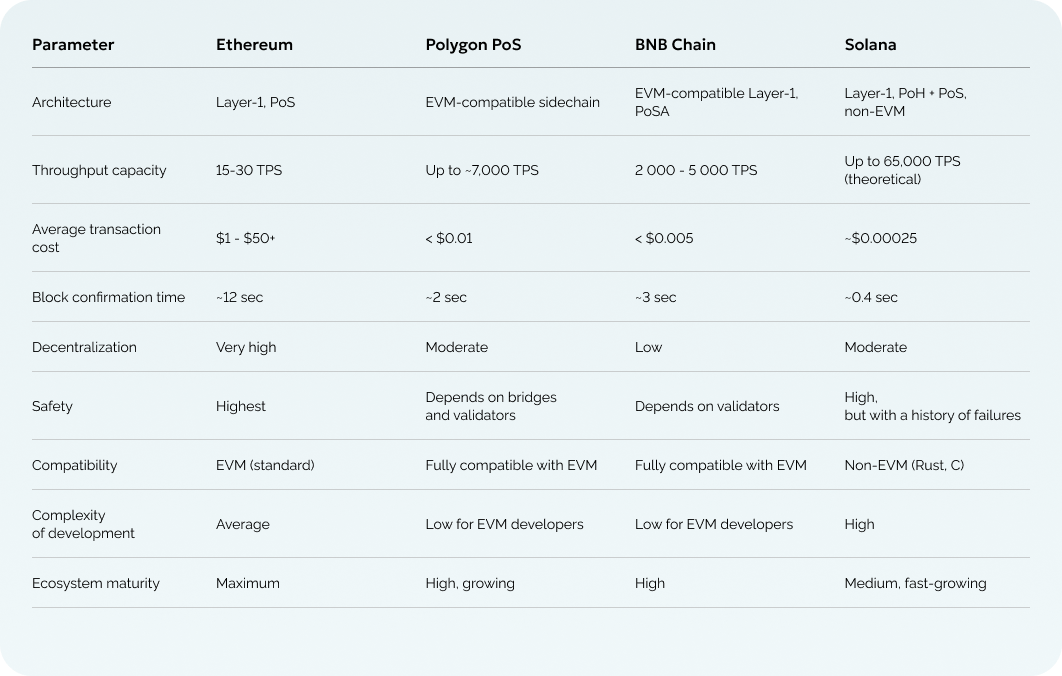

Comparative analysis of parameters

Criteria for selecting a network for the project

The decision is made after analyzing the answers to the following questions:

1. What is the transaction budget for the project’s economy?

- If a transaction cost > $0.01 is unacceptable, we exclude Ethereum.

- If the cost must be predictable, Solana has an advantage.

2. What is the expected transaction volume at peak loads?

- < 100 TPS: all networks are technically suitable

- 100 — 2,000 TPS: Polygon, BNB Chain

- 2,000 TPS: Solana

The TPS thresholds serve as a guideline for choosing a network. This is not an official classification, but a practical scale that helps determine which networks can handle the expected load.

3. How critical is decentralization?

- Critical: only Ethereum

- Important, but compromises are acceptable: Polygon, Solana

- Secondary: BNB Chain

4. Does the team have experience in blockchain development?

- Experience with Solidity: Polygon and BNB Chain

- Experience with Rust/C: Solana can be considered

- No experience: Ethereum/Polygon

5. Is integration with the Ethereum infrastructure required?

- Yes: EVM-compatible networks are preferred

- No: wider choice

Summary: When to choose which network

Choose Ethereum when you need to ensure maximum security for high-value assets. You consciously accept high operating costs as the price of reliability.

Choose Polygon when you need high speed and low cost in a familiar EVM environment. This is the optimal path for mass applications that want to remain in the Ethereum ecosystem.

Choose BNB Chain when the goal is to quickly deploy an EVM application with access to a wide audience. Speed and cost are strengths here, but at the expense of centralization.

Choose Solana when your application requires extreme throughput and fixed fees, and your team is ready to work with complex architecture.

The final decision should be based on prioritizing the requirements of a specific project. A successful strategy often involves a multi-chain approach: placing critical logic on Ethereum and deploying mass operations on a faster network.

If you need a detailed analysis of smart contract architecture or help choosing a network for your business case, you can explore our approach to smart contract development.

Rate this article!

Leave your comment